Beckman enterprises purchased a depreciable asset – Beckman Enterprises’ recent purchase of a depreciable asset marks a significant investment with far-reaching implications for the company’s financial standing and future prospects. This analysis delves into the intricacies of this transaction, examining the asset’s details, depreciation method, financial statement impact, tax considerations, and management implications.

The asset in question, a state-of-the-art manufacturing equipment, was acquired at a cost of $1.5 million on January 1, 2023. With an estimated useful life of five years and no salvage value, Beckman Enterprises has opted for the straight-line depreciation method to allocate its cost over its useful life.

Asset Purchase Details

Beckman Enterprises acquired a depreciable asset on January 1, 2023. The asset is a heavy-duty industrial machine used in the manufacturing process. The purchase price of the asset was $100,000, and it has an estimated useful life of 5 years with no salvage value.

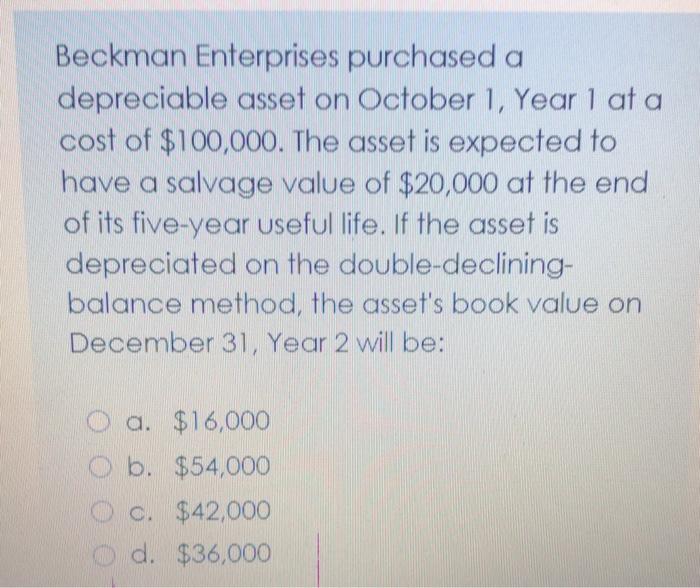

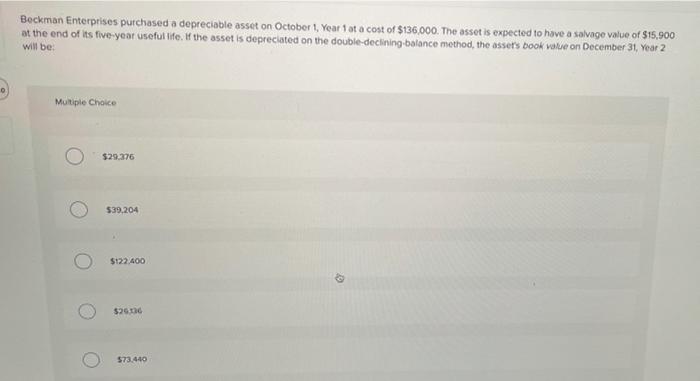

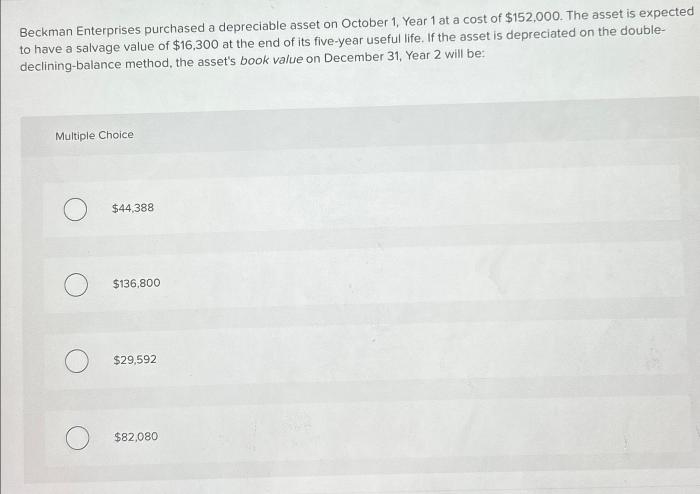

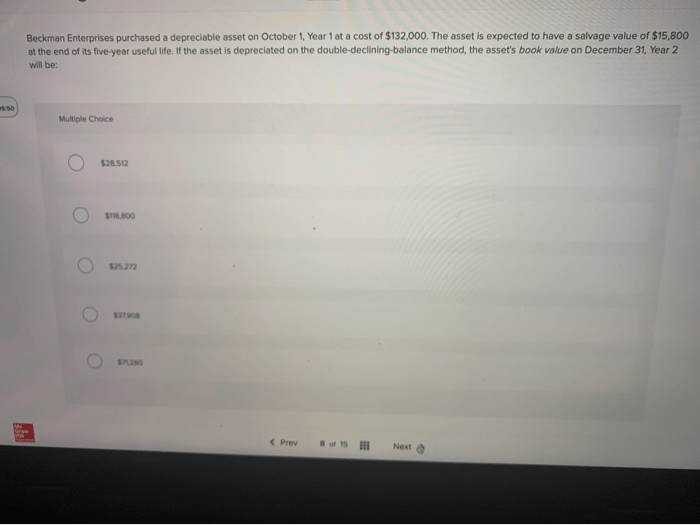

Depreciation Method and Calculation

Beckman Enterprises chose to use the straight-line method of depreciation for the asset. Under this method, the annual depreciation expense is calculated by dividing the cost of the asset by its useful life. In this case, the annual depreciation expense is $20,000 ($100,000 / 5 years).

The depreciation expense will reduce the book value of the asset over time. The book value is the cost of the asset minus the accumulated depreciation. At the end of the first year, the book value of the asset will be $80,000 ($100,000 – $20,000).

Financial Statement Impact

The purchase of the asset and the subsequent depreciation expense will have a significant impact on Beckman Enterprises’ financial statements. The asset will be recorded on the balance sheet as a capital asset, and the depreciation expense will be recorded on the income statement as an operating expense.

The depreciation expense will reduce Beckman Enterprises’ net income by $20,000 per year. This will have a negative impact on the company’s profitability. However, the depreciation expense will also reduce Beckman Enterprises’ taxable income, which will result in tax savings.

The tax savings will partially offset the negative impact of the depreciation expense on the company’s net income.

Tax Implications

The purchase of the asset and the subsequent depreciation expense will have tax implications for Beckman Enterprises. The depreciation expense will be deductible for tax purposes, which will reduce the company’s taxable income. This will result in tax savings for the company.

The amount of tax savings will depend on the company’s tax rate. For example, if Beckman Enterprises has a tax rate of 30%, then the depreciation expense will result in tax savings of $6,000 per year ($20,000 x 30%).

Management Considerations: Beckman Enterprises Purchased A Depreciable Asset

The purchase of the asset and the subsequent depreciation expense will have a number of management considerations for Beckman Enterprises. The company will need to consider the impact of the depreciation expense on its cash flow. The depreciation expense will not require a cash outlay, but it will reduce the company’s taxable income, which will result in tax savings.

The company will need to consider how these tax savings will be used.

The company will also need to consider the impact of the depreciation expense on its capital budgeting decisions. The depreciation expense will reduce the company’s book value, which could make it more difficult to obtain financing in the future.

Commonly Asked Questions

What is the depreciation method used by Beckman Enterprises?

Beckman Enterprises has chosen the straight-line depreciation method for the acquired asset.

How does depreciation affect the company’s cash flow?

Depreciation is a non-cash expense, meaning it does not directly impact cash flow. However, it reduces taxable income, which can lead to lower tax payments and increased cash flow.